What are Invoice Factoring Services?

Our invoice factoring services turn your accounts receivables (invoices) into cash flow by eliminating the waiting period while your invoices are paid. This process works for companies with a business-to-business (B2B) and business-to-government (B2G) model.

This provides businesses with the opportunity to have immediate consistent cash flow for ongoing operations and additional cash reserves to fund growth opportunities. For many businesses, maintaining enough cash can be difficult, especially if a business is young or experiencing rapid growth.

United Capital Funding provides help to these businesses through payroll funding services and invoice factoring services which gives them working capital quickly.

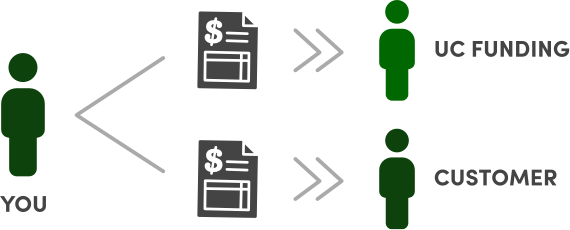

How Invoice Factoring Works

Selling invoices owed by another business or government entity to a third-party buyer (a Factor); invoice factoring services are one way to fund your business. Prior to your first funding, we work with you to introduce ourselves to your customer as a new financial partner. This allows us to verify invoices efficiently in step #2.

01

A copy of your invoice is provided to United Capital

02

United Capital Funding verifies the invoice with your customer, then pays you 80-90% of the invoice (advance) in cash.

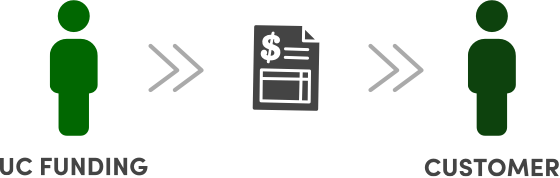

03

United Capital Funding acts as your accounts receivables department and services the invoice.

04

Your client pays 100% of the invoice to United Capital Funding at our secure lock box facility.

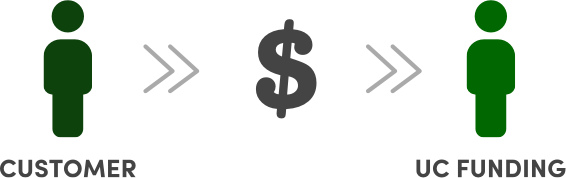

05

United Capital Funding pays you the 10-20% balance less a small professional fee (reserve).

How Accounts Receivables Factoring Works

Accounts Receivables Factoring with United Capital Funding is fast, simple and hassle-free for businesses with a business-to-business (B2B) and business-to-government (B2G) model. Clients fill out a schedule of invoices they wish to sell when capital is needed. Upon receipt of the schedule, United Capital Funding will fund up to at least 80% of the total amount on the same business day. Once the invoice is collected at a secure lock box, the reserve account (less a small fee) will be returned to you. Once the invoice factoring services have been completed, our clients enjoy the benefits of same day funding, as opposed to waiting up to 90 days for payment.

Accounts Receivable Factoring vs. Traditional Bank Line of Credit

- Invoice factoring services focus on the credit worthiness of your customers, not your company.

- Unlike a typical bank loan, factoring clients are not subject to tightening credit availability due to credit cycles, economic volatility or market fluctuations.

- Traditional bank loans have restrictive covenants on net worth, leverage, profitability, dividends and other restrictions, which inhibit sales growth.

- Typical bank loans focus on the strength of the balance sheet, the profit and loss statement and cash flow of your company.

- Factoring de-leverages your balance sheet.

- Getting set up with United Capital is quick, free and with no long approval process.

Does my business qualify for invoice factoring services?

Clients of United Capital Funding include businesses that have…

- Final sale invoices to another business or government entity (not consumer sales)

- Sales from $20,000 to $5,000,000 monthly – including startups and companies with historical losses.

- Capital needs to allow them to grow in their industry.

- Limited collateral other than commercial invoices.

Submit a connect form below to discuss your working capital needs, or if you currently have invoices and are ready to apply – fill out our online application, there’s no cost to apply.

Connect with United Capital Funding