As most of us would agree, the current and lingering COVID-19 pandemic has altered how we live, eat, and pay our bills as consumers and SMEs. It should come therefore as no surprise that commercial banks and others who are in the B2B payment industry are focusing additional time and capital to provide online payments and services to their clients. The ability to process payments electronically in the credit and debit industries will take on an increasingly important role and it seems almost certain that this will be a key revenue generation source in the financial services sector in the near and long term future.

There are many benefits to using online payments in both the B2B and B2C sectors. Transactions are started and completed in a matter of seconds versus days, weeks or even months. Online payments leave a 100% transparent “paper” trail and can provide all parties involved greater financial flexibility and control when compared to slower and more cumbersome paper payments. The factoring industry is of course no stranger to the B2B payment process and needs to make sure it continues to be at the leading edge to remain competitive for their B2B and B2G clients.

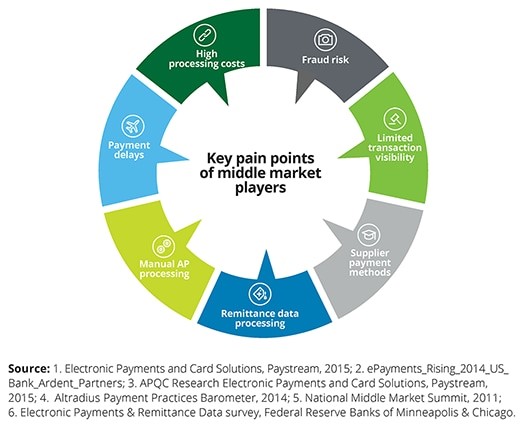

The ability to utilize B2B online payments can help eliminate or at a minimum reduce most if not all of the well documented pain points that have plagued SMEs in the past. These pain points include but are not limited to the 8 discussed in a recent article I uncovered in my research for this article. Their Accounts Payable lifecycle analysis revealed eight key pain points and unmet needs faced by middle market buyers and suppliers. They are summarized in the graphic here.

I have summarized the Deloitte findings of where the pain points exist for SMEs below:

- High processing costs. 35% of SMEs reported high processing costs as a major challenge with traditional payment methods. It costs a typical Accounts Payable (AP) organization nearly $8 to process a single supplier payment. 62% of the total cost stems from labor.

- Payment delays. 30% of SMEs mentioned payment processing time as a major issue. Payment delays can result from a delay in payment from suppliers/buyers or slow processing methods. It takes an average of ~30 days to complete a payment, and around 47 % reported getting paid late for their products or services.

- Manual AP processing. This is a major issue for many SMEs. They lack adequate automation capabilities for AP processing due to limited back office integration with electronic payments and electronic invoices, lack of IT resources, and difficulty in convincing customers/ suppliers to use electronic payments.

- The risk of fraud. This is another huge problem for many SMEs. Deloitte noted that in a recent study 22% of SMEs had been victims of some form of payment fraud in the past.

- Limited transaction visibility. Due to the lack of a comprehensive approach, many SMEs struggle with multiple payment methods that end up causing them to bear extra costs, delays, chargebacks, and payment cycle disruptions.

- Supplier payment methods. Many SMEs are confronted with a “mismatch” in the payment methods preferred by buyers and suppliers. Buyer payment decisions are heavily dependent on the payment methods their suppliers use.

- Remittance data processing. The task of reconciling multiple invoices and receiving and processing remittance data can be a head ache for SMEs for a number of reasons including but not limited to missing data, the use of different file formats, and lack of back-office support for automated remittances.

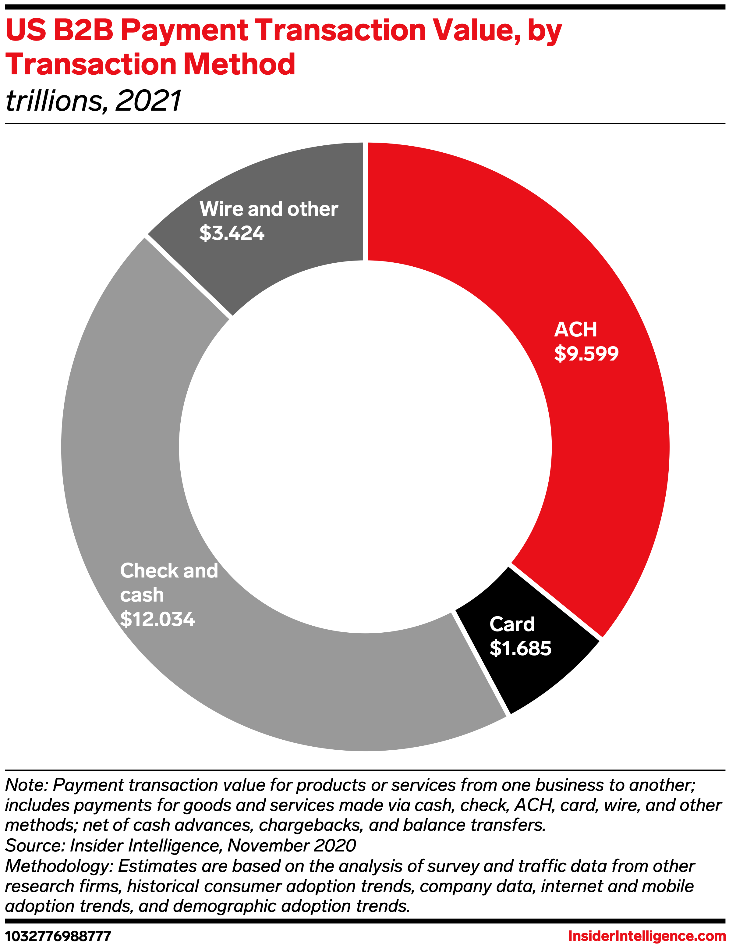

I have often wondered how large is the current size of the B2B payment industry is in the United States and undertook some quick research to seek an answer to this question. According to recently published data the B2B United States payment market is expected to grow to nearly $27 trillion in 2021. It is estimated that B2B payments volume totals approximately $120 trillion per year globally. So needless to say this is an enormous market that merits our attention and discussion in the global factoring industry.

In the United States, the B2B online payment industry has been a laggard relative to other types of payments in the recent past. But given the size of the industry as a whole, any RTP or “real time payment” provider who garners even a small penetration rate could be the recipient of a windfall form of revenue stream for years to come. Consider the actual numbers for just a second: even a tiny 1% successful penetration rate in only the current size of the payments made by check or cash would result in an incremental extra $120 Billion in volume to the RTP provider. (1% times $12 trillion = $120 Billion). This the increase on an annual basis.

As can be see below, checks and cash still constitute 45% of the total US B2B payments made on an annual basis. The total estimated B2B payment volume in the United States is projected to be $26.7 trillion for the year ended December 31, 2021. Of this total, $10 trillion or 38% are made via Automated Clearing House (ACH) and another $3.4 trillion use wire transfers as the form of payment. Only $1.6 trillion payments are made in the B2B universe using a credit card. The data in the chart below is net of cash advances, chargebacks and balance transfers.

In summary and conclusion, the factoring industry needs to be cognizant of and embrace methods to collect B2B Accounts Receivables as quickly and efficiently as possible. Knowledge of trends occurring in the B2B payment transaction method summarized in this short article could help firms in the industry to seek and find ways to convert current payments made by check to either ACH, EFT or both. After all, knowledge is power, but only when shared.